Aaron Kraft

Simplify your Commercial Real Estate DecisionsUnderstand the market, your options, and how to find value on Seattle's EastsideHundreds of lease and sale transactions completed

Call or Text @ (425) 283-8676

Blog

October 16, 2023While nobody will tell you that office sentiment is at an all time high today, it is important that we recognize that we are no longer at the bottom of the cycle.The office cycle took a major turn in 2020 and has since rebounded. Some companies made long-term decisions at that point, which will have an impact on expiring leases in 2024 and 2025, but multiple years of negative net absorption should not distract us from the fact that companies are making new leasing decisions today.Pokemon is close to leasing 380,000 SF in downtown Bellevue, while ByteDance just committed to an additional 66,000 SF.These were leases that were not being signed in 2021 or 2022.There is reason for optimism with the office market. The bottom line is that companies are committing towards being in the office and are beginning to make decisions that reflect that.Meanwhile, Tenants have an opportunity to achieve concessions that were not available a few years back. While asking rates have not materially dropped, net effective rents have. Continue to watch this trend and evaluate any offers on the table with what net effective rents looked like last time you signed your lease.Construction costs/TIs have risen substantially over the last few years. Until that changes, we likely won't see a dramatic change in asking rates, because so much of the rent being paid is used towards funding the initial buildout.Overall, I am optimistic about where the market is heading. If you have a lease expiring in the next two years, you should be giddy with anticipation for the process.You timed things correctly.

October 3, 2023Owl Labs recently conducted a study on The State of Hybrid WorkHere are some of their Key Findings:69% of respondents believe that their company is requiring them to work from the office because of traditional work expectations23% of employees changed companies in 2023, and this was more common among full-time office workers (26%) than hybrid/remote workers (17%)1 in 3 workers (33%) spend 31-45 minutes commuting one-wayAlmost half (46%) of workers are “polyworking” with a side hustle or additional job, and a further 36% plan on starting one in the future1 in 4 workers (25%) would be willing to sacrifice 15% of their annual salary for flexible working hoursMore than half (58%) of hybrid employees “coffee badge” - also known as showing face at the office and then leaving56% of workers said that their level of work-related stress has increased since last year94% of workers say they could be convinced to come to the officeIf no longer able to work remotely, 29% of hybrid and remote workers would expect a pay increase to make up for additional costsOnly 37% of employers have upgraded their video meeting technology in 202354% believe that business trips in their organization have returned to pre-pandemic levels68% of managers believe that their hybrid/remote working employees are missing out on impromptu or in-formal feedback80% of workers experience lost time due to technical difficulties during online/hybrid meetings44% of workers said generative AI will help them do their job faster and more effectively in the next five years64% of respondents feel that their company uses too many communication platforms______________________________________________________________So, what does this all mean?There is a real disconnect between management and their employeesIf employees are commuting an hour and a half per day to "Coffee Badge", then management is not providing compelling evidence that there's a benefit to the employee for working in the officeManagement is then worried that their employees are missing out on valuable feedback, however what they deem valuable and what the employees deem valuable are different, considering the respondents that are expecting a pay increase to compensate for the added cost of coming into the officeBut most shocking is that 46% of employees are "polyworking"People work second jobs primarily out of necessity, which tells me they are feeling underappreciated at work, under compensated, and on edge about their security with the companySo what happened to "company culture" and employee wellbeing?These were such critical objectives for companies during the last cycle, but seem to have been lost since COVIDCompanies need to demonstrate that they care about their employees againThey need to show they value their service to the company and it will be reciprocatedEven people I know who were raving lunatics about their companies a few years ago seem disconnected nowOne thing is certain, these results show that it is not a one off employee that feels what's going on, it's large swaths of the employment baseIt's not on the employee to engage with the companyTheir job is to get their work doneIt's the companies job to make raving lunatics out of their employees againAnd they can't do it with free snacks this time aroundThey need to do it by demonstrating that they care about the people behind the badgeOnly then do we see these numbers trend in the other direction

September 20, 2023Daycares require:-75 sf/kid (that’s outside) of outdoor space-35 sf/kid of floor space inside classrooms, meaning common areas and areas taken by cabinets etc don’t count (big load factor)This means, if you have 3,000 sf of outdoor space you can have 40 kids outside at any given timeKids go outside twice/day + 2 hours are eliminated mid day for nap and lunchFor a daycare that runs 9 hours/day, you have 7 hours of possible outdoor time, but the first hour is not functional so it’s 6You then have 3 waves of playgroundCapacity = 120 kids120 kids x 35 sf/kid = 4,200 sf of indoor classroom floor space/50% load factor = 8,400 sf of total spaceThere are plenty of vacant spaces these operators would go, but don’t have sufficient playground spaceEconomies of scale would make larger spaces more cost efficientOutdoor space is the bottleneck to more affordable daycaresIronically, outdoor space is rarely charged forOne solution would be to include specific/usable indoor common areas as outdoor spaceAnother would be to produce playground equipment and that can effectively double playground space by creating a second levelModify the equation one way or anotherBut there’s a solution

August 29, 2023Introduction:

The city of Bellevue, Washington has long been a focal point of economic growth and innovation, serving as a tech hub and a sought-after location for businesses. As of 2023, the office market in Bellevue reflects a dynamic and evolving landscape shaped by various factors, including remote work trends, industry shifts, and the ongoing response to the global pandemic.Remote Work Impact:

The COVID-19 pandemic catalyzed a significant shift in work dynamics, prompting businesses to embrace remote and hybrid work models. This change had a notable impact on the office market in Bellevue, with many companies reevaluating their office space needs. While some adopted flexible arrangements, others downsized or shifted to fully remote operations. As a result, the demand for traditional office spaces saw a transformation, influencing both vacancy rates and leasing patterns.Tech Industry's Influence:

Bellevue's strong ties to the tech industry have continued to drive demand for office space. The presence of established tech giants and the influx of startups seeking to tap into the innovation ecosystem have contributed to sustained interest in premium office locations. As the tech sector continues to evolve, so too does its influence on the demand for specialized office setups and collaborative environments that foster creativity and teamwork.Adaptation and Reimagining Spaces:

Office landlords and developers in Bellevue have demonstrated resilience by adapting to the changing market conditions. Many have reimagined office spaces to align with the evolving needs of businesses. This includes creating flexible layouts that prioritize collaboration, incorporating wellness amenities, and integrating advanced technology infrastructure to support hybrid work arrangements seamlessly.The Outlook Ahead:

As the world moves towards a post-pandemic era, the future of the Bellevue office market remains intriguing. The return to in-person work, combined with the lessons learned from remote work experimentation, will likely reshape the demand for office spaces. Businesses that value face-to-face collaboration and innovation may drive a resurgence in leasing activity. Striking the right balance between traditional office setups and remote work will be a key consideration for both businesses and landlords.Conclusion:

The office market in Bellevue, WA is a reflection of the broader changes sweeping through workplaces worldwide. While the initial impact of remote work and the pandemic is evident, the city's resilient tech-driven economy and innovative spirit continue to fuel demand for office spaces. The path forward involves adapting to evolving work dynamics, embracing flexibility, and reimagining office environments to meet the needs of a rapidly changing business landscape.

Market Data

October 9, 2023Much of what I sell on the Eastside is Owner/User office properties under 25k SF.Since 2015, we have seen 167% increase in values of these properties. There has been 244 of such sales.It has hardly been a strait line, however, with most of the price growth occurring in 2018 and 2021.

| Year | Price/SF | YoY Growth |

|---|---|---|

| 2015 | $313.50 | |

| 2016 | $334.42 | 6.67% |

| 2017 | $351.64 | 5.15% |

| 2018 | $420.68 | 19.63% |

| 2019 | $400.95 | -4.69% |

| 2020 | $402.84 | 0.47% |

| 2021 | $515.82 | 28.04% |

| 2022 | $565.99 | 9.73% |

| 2023 | $524.80 | -7.28% |

October 5, 2023Eastside office vacancy is 9.54% currently, up 178 bps from 7.76% last quarter and up significantly by 409 bps from 5.45% a year ago.Eastside office inventory currently stands at 58.3M+ s.f.8 major Eastside office projects under construction (excluding the 3M s.f. Microsoft campus expansion) collectively totaling 3.58M+ s.f.; a healthy 71% is pre-committed.One significant office delivery in the 3rd quarter; the Amazon leased Tower 555 project (940K s.f.) developed by Vulcan.Eastside availability increased for the fourth consecutive quarter going from 15.60% last quarter to 16.90% currently, well above the 11.60% mark a year ago.Net Eastside office absorption over the quarter was negative at -179.6+ s.f. This compares to 671.8K+ s.f. last quarter and 379.4K+ s.f. during the 1st quarter 2023. Year-end 2022 net absorption was negative at -87.3K+ s.f.The current amount of available new Eastside office construction to absorb is 1.05M+ s.f., compared to historic annual net absorption of just under 500K+ s.f. historically.Eastside office leasing over the quarter totaled 112 deals containing 415.5K+ s.f. in total volume nominally exceeding last quarter’s total volume (397.1K+ s.f.).Bellevue’s CBD office vacancy increased to 9.5% from 8.4% last quarter. The average CBD rent quote is $50.68/s.f./yr, down 6.5% from $51.01/s.f./yr last quarter.Vacancy rates in key peripheral Eastside office submarkets changed over the quarter to 8.4% and 6.5% for Redmond and Kirkland, compared to 8.1% and 6.8% last quarter, respectively.The average rent quote for the Eastside is currently $40.54/s.f./yr, down $1.19/s.f./yr from $41.73/s.f./yr last quarter, but above $39.49/s.f./yr one year ago.

Puget Sound Office Sales Over $10M

| Name | City | Date | Price | SF | $/SF |

|---|---|---|---|---|---|

| Erling O Mork Building | Tacoma | September 2023 | $27,271,000 | 149k | $182 |

| Sky River Medical Center | Monroe | August 2023 | $21,000,000 | 49k | $428 |

| Kobe Park Building | Seattle | July 2023 | $9,750,000 | 31k | $310 |

| Cascade View East | Redmond | June 2023 | $10,000,000 | 14k | $713 |

| DOE Building | Bellevue | June 2023 | $18,000,000 | 60k | $298 |

| Everett Clinic | Arlington | May 2023 | $32,500,000 | 68k | $475 |

| View Ridge Plaza | Everett | May 2023 | $15,500,000 | 22k | $705 |

| Gateway One | Bellevue | February 2023 | $35,000,000 | 112k | $313 |

| Parkside Building | Tukwila | January 2023 | $11,100,000 | 43k | $260 |

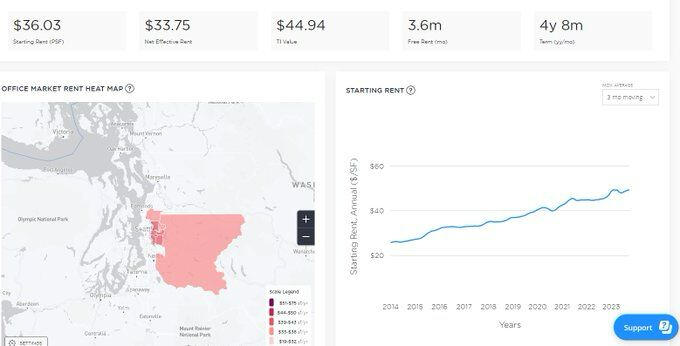

10/4/2023According to Compstak data, over the past 6 months, average leases terms have trended shorter on the Eastside, going from 4 years and 11 months over their 24 month trailing average to 4 years and 8 months over the past 6 months.Rent Abatement has increased by 12.5% in that timeframe, as well.Net Effective Rents are down 3% from their 24 month average, but that gap will widen, even if we don't see a significant decrease in asking ratesNet Effective Rents are highly correlated by construction costs, which landlords are covering more of, through higher TI Allowances

Follow the Latest Eastside News Here

October 9, 2023 - Bothell-based shingles vaccine maker Curevo Vaccine has taken 13,642 square feet of office space at Plaza at North Creek in Bothell.

October 6, 2023 - Stanford Hotels Group is replacing two office towers with residential buildings and adding room for a grocery store at its Cloudvue project.

October 6, 2023 - Almost two-thirds, 62%, of U.S. CEOs told the accounting firm that they envision the working environment for corporate employees whose roles were traditionally based in offices will be back in their physical workplaces in the next three years, according to the KPMG 2023 U.S. CEO Outlook survey of more than 1,300 CEOs at large companies globally, including 400 in the United States.

April 13, 2023 - Despite challenges surrounding office, Bellevue has proven to be a bright spot

How I Help You

I joined Kidder Mathews in 2012 and in my 11-year career, I have worked with both Tenants and Investors range in all sizes, from start-up companies to large public firms. Regardless of your size, you will receive the highest service level, guidance, and world-class resources that will lead to better facility decisions.I specialize in:- Tenant Representation including relocations, lease renewals and marketing subleases- Landlord Representation with leasing vacancies and renewing existing tenants- Purchase and Sale Negotiations involving both investment and owner/user properties- Industrial and Office Valuations- Property DispositionsThe common thread of everything I do is that I ensure that my clients maximize the investment they make in their Commercial Real Estate.Whether it means maximizing cash flow, reducing downtime with vacancies, minimizing out of pocket expenses, or identifying underutilized assets, you will always understand how individual deal points impact your bottom line.Throughout my career, I have represented hundreds of Tenants, Landlords, and Investors in complex real estate transactions including sales and all forms of leasing.My guarantee to you is that you will see every deal, understand market conditions, and identify off-market value opportunities.

Testimonials

Tenant Representation

"I worked with Aaron over a period of about one year as we searched for new office space in Redmond, WA. What made our search unique is that our process started just before COVID and as events began to play out we needed to consider macro events and adjust our plan, and schedule accordingly. Aaron was a true professional and led us through the process during this unique time, and ultimately helped us to land an ideal outcome. He was professional, diligent, and responsive throughout. Aaron gets our highest recommendation"Rob Wright

CFO

Prescryptive Health, Inc.

"Aaron has been a great help to our organization in scoping and delivering on our search for new office space. Aaron has always exhibited outstanding professionalism and attitude. It has been reassuring having Aaron looking out for our best interest in what can be a challenging process for the uninitiated"Gil Glass

CEO

Logis Solutions

"Working with Aaron was a really smooth experience. He was able to understand our needs and timeline and find something fairly quickly within our budget. Even after helping me secure the office lease, he's been tremendously helpful in providing resources as well as answering any questions related to the lease"Paul Ross

Owner

City Home Team

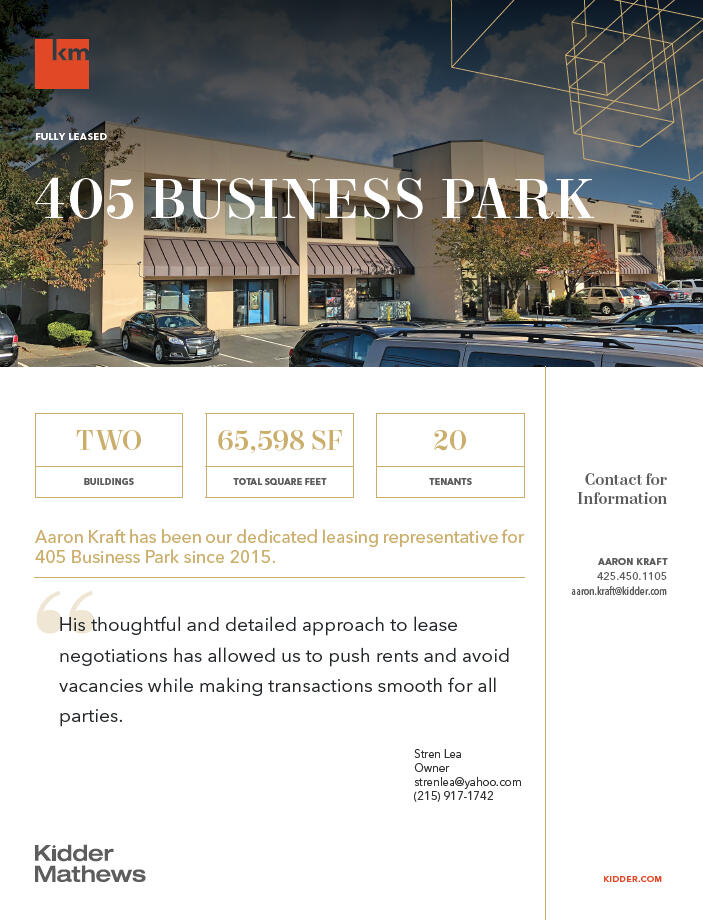

Landlord Representation

Disposition Representation

The purpose of this letter is to recognize and recommend the outstanding service, professionalism, and most importantly, the expertise of Aaron Kraft as a commercial real estate professional.We started to work with Mr. Kraft about two years ago regarding the potential sale of our building in downtown Bellevue. Due to our circumstances with our current tenants, we were particularly anxious to list the property on the open market, thinking that they would leave.In our general discussions with Aaron, we determined what sort of buyer we should focus on. From there, he did the all-important legwork in presenting it to several interested buyers eventually finding a match that met our qualifications. Therefore, he was able to help us pair the highest use value with the right buyer without endangering our cash flow.After finding the right buyer, Mr. Kraft also guided us through the closing process, making it as easy as any transaction of this size could be. His willingness to work with us, even at odd hours, with inspectors, architects, and the future owners, to minimize any distraction to our operations was tantamount to maximizing value for us.Aaron has earned my highest recommendation as a Real Estate Broker, and as a result, I would highly recommend him to those working on commercial real estate in the King County area.Very truly yours,Michael J. Zuccarini

Smith & Zuccarini, P.S.